Subscription Cycling

The Circana study of 5,000 US viewers reveals that while streaming subscriptions are increasing (including free, ad-supported options), engagement with individual platforms is decreasing. The industry is now focusing on “subscription cycling” (rotating services) rather than just “churn” (cancellation). A key challenge is that younger viewers often cancel immediately after finishing content. With rising living costs, consumers are more selective, pushing streaming services towards bundling strategies to retain subscribers.

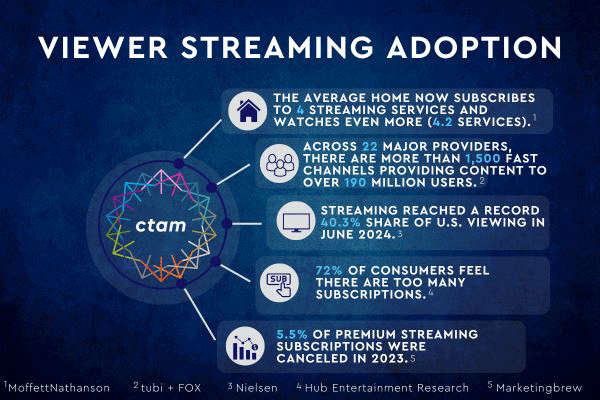

Trends Shaping the Industry

- Subscription Growth – 90% of U.S. internet households now subscribe to at least one streaming service, up from 87% six months ago.

- Free Streaming Expansion – Free, ad-supported services like Pluto TV and The Roku Channel have grown at their fastest rate in five years.

- Subscription Cycling – 12% of households cancel a service as soon as they finish a specific show or movie, with the behavior most prevalent among younger viewers.

- Economic Pressures – Rising costs are leading consumers to be more selective about their streaming subscriptions, increasing cancellations.

Loyalty Perks

As streaming services fight for consumer loyalty, partnerships are becoming a key retention tool. Companies across industries are bundling streaming perks into their own offerings:

- Walmart+ includes Paramount+, mirroring Amazon’s Prime Video model.

- Grocery chains like Kroger offer Disney+ perks.

- DoorDash and Instacart bundle Max and Peacock with their premium memberships.

- American Express provides $240 in streaming credits for premium cardholders.

Additional Resources

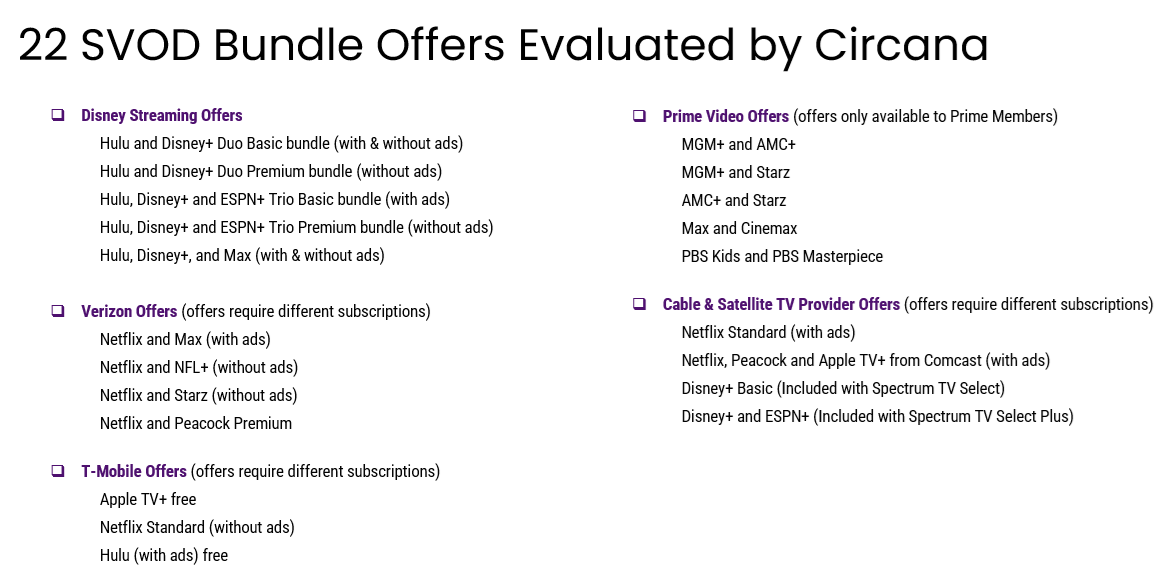

View a snapshot of 22 SVOD bundles evaluated in the study

Plus, explore the bundles consumers want – beyond just video – through insights from CTAM and Magid’s Content + Connectivity Consumer Insights study.

CTAM and Magid’s Content + Connectivity Consumer Insights Study

Consumers face an ever-growing complexity of video service options when it comes to satisfying their video needs. They seek not more services and options – in fact, churn continues across pay TV services and is growing for many SVODs – but instead a centralized experience that can simplify, optimize, and personalize their viewing experience.

Consumers desire flexible, customizable bundles that allow them to easily manage their subscriptions and save money. Learn more about how content discovery is critical to success, how FAST services are leading the way and how loyalty programs are being tested below.